palm beach county business tax receipt phone number

Palm Beach County Florida - Constitutional Tax Collector - Public Access Portal for Local Government. Application for Local Business Tax Receipt.

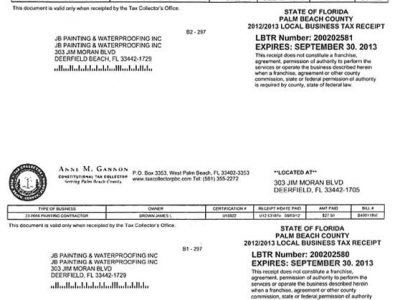

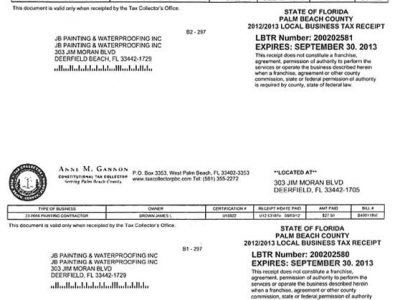

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

Royal Palm Beach FL 33411.

. Business Tax Receipts. 360 South County Road. Village Hall 1050 Royal Palm Beach Blvd.

Palm Beach Gardens FL 33410. West Palm Beach FL 33401 561 355-2264 Contact Us. State of Florida Fictitious Name Registration Number.

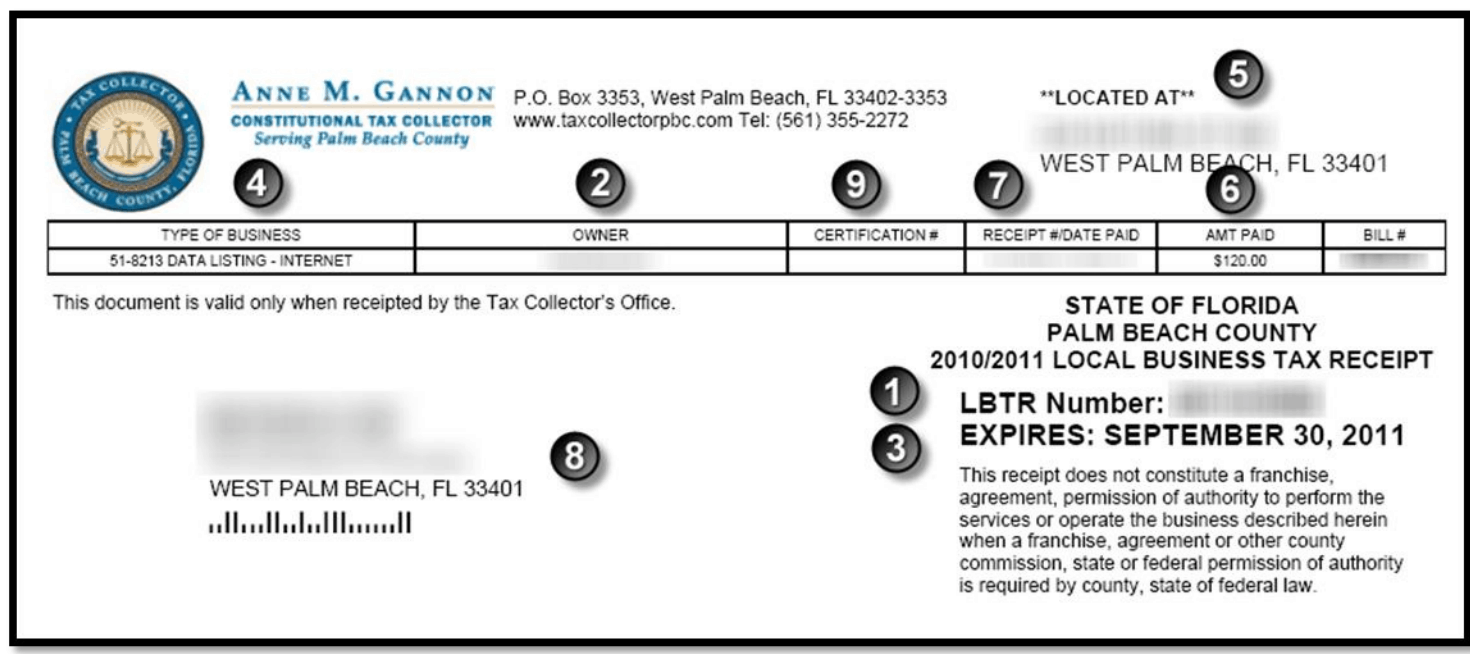

4 PALM BEACH COUNTY LOCAL BUSINESS TAX RECEIPT formerly Occupational License. Contact the Tax Collectors at 561-233-355-2264 or. The City of West Palm Beach Business Tax classifications and rate schedule can be found in Section 82-163 of our municode.

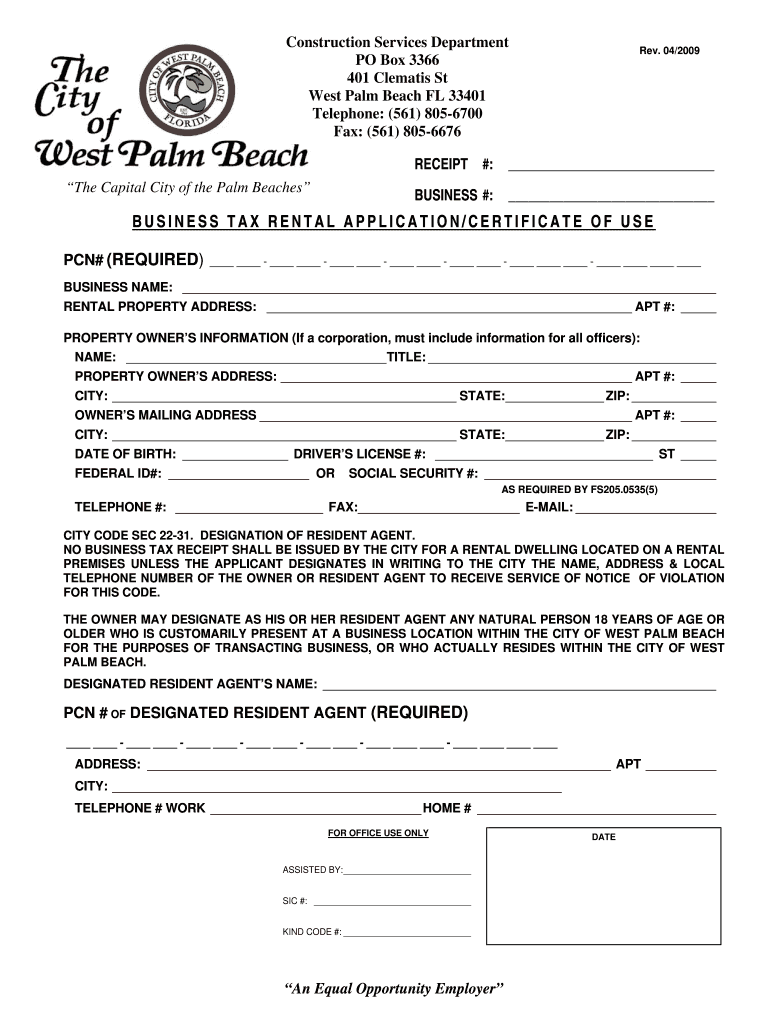

Allow 7 to 10 business days to process. Development Services Department 401 Clematis Street West Palm Beach Florida 33401 Phone. Town of Palm Beach.

Palm Beach FL 33480. The entire LBTR number must be entered to perform a search. Business Tax Department PO.

APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT __ NEW Business Tax Receipt __ CHANGETRANSFER Circle. PLEASE ATTACH A COPY OF YOUR CURRENT PALM BEACH COUNTY LOCAL BUSINESS TAX RECEIPT. If the use meets the Zoning Code requirements then the applicant will pay a fee schedule inspections receive the appropriate sign-offs from zoning code enforcement and fire rescue then submit the completed form to the Tax Collectors office who will then issue the Business Tax Receipt.

Palm Beach County Local Business Tax Receipt 305 300 0364. Office Depot OfficeMax Rewards Program Program Terms and Conditions May 1 2022 Membership Eligibility. Mail completed application to.

PO Box 2029. Box 3715 West Palm Beach FL 33402-3715. The new Business Tax Receipt year begins on October 1 2021.

The maximum fee is 23625 for a company or business with 51 or more employees. Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No. LBTR Number is a ten-digit number found on your Business Tax Receipt.

Palm Beach Gardens FL 33410. Palm Beach County Tax Collector Attn. Box 3353West Palm Beach FL 33402-3353.

Delinquent Local Business Tax. The fees increase proportionately to the number of employees a business has. Application For a Palm Beach County Local Business Tax Receipt.

Call the phone number as early as possible or after 6pm. Hours Monday - Friday 800 am - 400 pm. Applicants must apply with the Village of Royal Palm Beach and obtain Zoning approval PRIOR to applying for the Palm Beach County Business Tax Receipt.

FAILURE TO HAVE A CURRENT PALM BEACH COUNTY LOCAL BUSINESS TAX RECEIPT WILL RESULT IN THE. There may be other requirements in order to issue your business tax receipt. Tax Collector Palm Beach County 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401.

Royal Palm Beach FL 33411. Village Hall 1050 Royal Palm Beach Blvd. Looking for FREE property records deeds tax assessments in Broward County FL.

Location Ownership Legal Business Name Dba Name Applicant. Burkhart Today To Assist With All OF Your Local And County Tax Receipt Questions And Needs At 561 880-0155. PB County Business Tax Receipt.

West Park Area Broward County Local Business Tax Receipt 305 300 0364

Palm Beach County Local Business Tax Receipt 305 300 0364

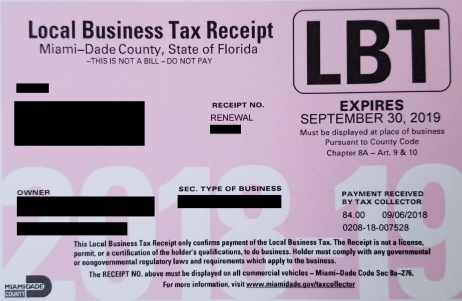

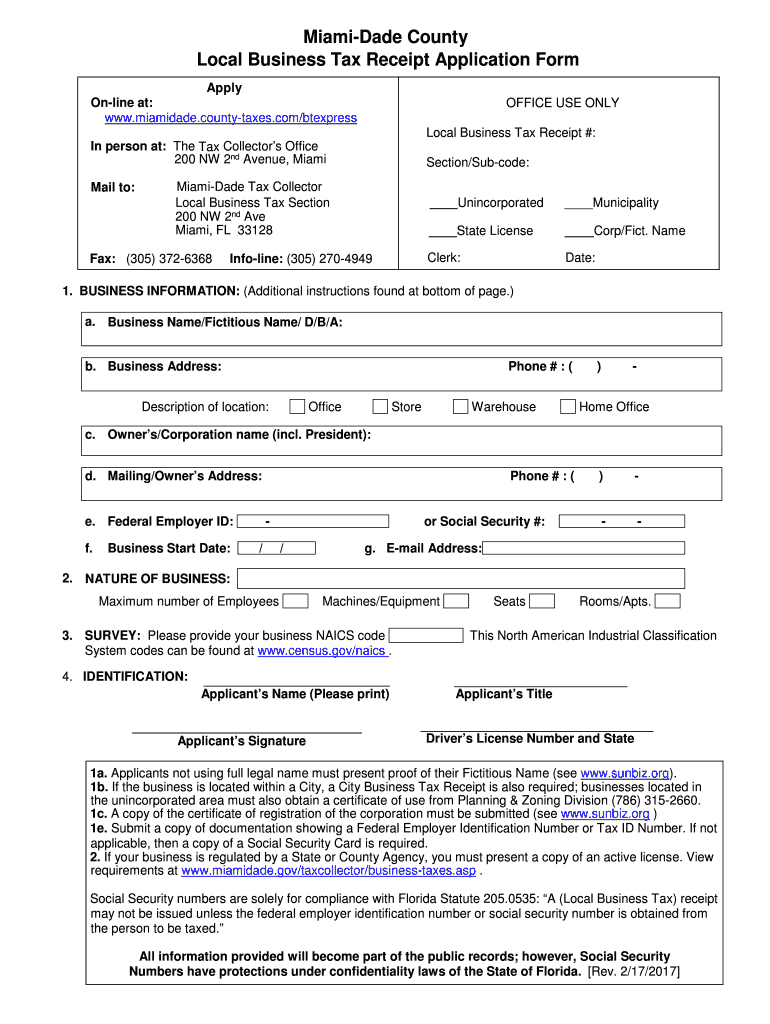

Miami Dade County Local Business Tax Receipt 305 300 0364

Permit Source Information Blog

Business Tax Rental Application Certificate Of Use City Of West Palm Web Fill Out And Sign Printable Pdf Template Signnow

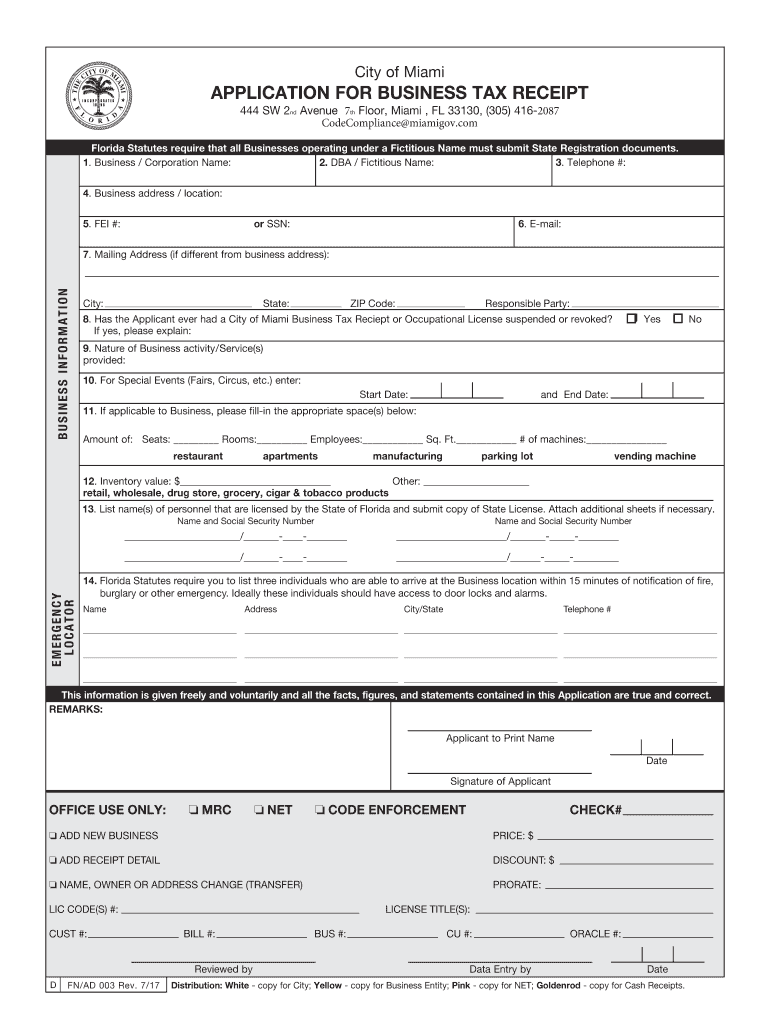

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Local Business Tax Constitutional Tax Collector

Local And County Tax Receipt Laws In Palm Beach County

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms